How Things Work – A Brief History of Reality

Book I – Dualism (Adam Smith & Mutually Beneficial Exchange)

Actually be the smartest person in the room!

Tuesday, April 5, 2022

“The learned ignore the evidence of their senses to preserve the coherence of the ideas of their imagination.” – Adam Smith

CONSIDERATION #25 – “ADAM SMITH” (Mutually Beneficial Exchange)

PREFACE

Welcome Everybody!

“All systems are capitalist. It’s just a matter of who owns and controls the capital — ancient king, dictator, or private individual.”

― President Ronald Reagan

Although containing more than four letters, capitalism has become a “dirty word” over the past few decades or so; essentially taking on the connotation of greed and self-gratification. However, most people do not really understand what capitalism is or how much it has improved our world in “real,” measurable, and practical terms since its conception by Adam Smith.

“The world runs on individuals pursuing their separate interests.

The great achievements of civilization have not come from government bureaus. Einstein didn’t construct his theory under order from a bureaucrat. Henry Ford didn’t revolutionize the automobile industry that way. In the only cases in which the masses have escaped from the kind of grinding poverty you’re talking about, the only cases in recorded history, are where they have had capitalism and largely free trade. If you want to know where the masses are worse off, worst off, it’s exactly in the kinds of societies that depart from that. So that the record of history is absolutely crystal clear, that there is no alternative way so far discovered of improving the lot of the ordinary people that can hold a candle to the productive activities that are unleashed by the free-enterprise system.”

― Milton Friedman, Nobel Prize Economist

Capitalism is as simple as pie: pizza pie. Adam Smith saw the extreme limitation on wealth imposed by the essential premise of Mercantilism, and that having only a single pizza (wealth limited to gold, silver, and land) available for everyone meant endless violence, war, and ultimately a limited few who would actually eat. For Smith, the solution wasn’t about getting a bigger slice of the pie; it was about finding a way to make more pizzas!

Adam Smith is renowned as the father of economics and the inspiration for Classical Economic Theory. On March 9, 1776, in his two-volume breakthrough set of five books, “The Wealth of Nations,” Smith revolutionized the import/export business, created a new economic concept called Gross Domestic Product (GDP), and made a passionate argument for Free Exchange.

Before Capitalism

It is almost unimaginable for a modern-day American to truly understand and appreciate just how horrible the world used to be for nearly every human being in it. Prior to capitalism and the modern state, almost the entire population of the planet lived a life of subsistence; barely surviving day-to-day, until the day they finally died. It was not uncommon for women and infants to die during childbirth; simply surviving childhood was a very difficult process, with child mortality rates estimated as high as fifty percent. Even if you survived childhood, other life-threatening obstacles included plague, famine, bad weather, street violence, heresy, hunting, tuberculosis, malnutrition, infection, the danger of traveling, and war. Life expectancy ranged from an average of twenty-five to fifty years depending on sex and social/economic status. If you could survive childbirth, childhood, and all of the possible threats to your life faced on a daily basis, it was possible, though not common, to live past the age of sixty.

“By modern standards, everyone was dirt poor in the Middle Ages. Even the wealthiest lacked the ‘things’ that everyone but the truly homeless now take for granted: electricity, indoor plumbing, central heating and air conditioning, telephones, washing machines, automobiles. There were no TVs or movies, no radios or CD players, no subways or buses, no supermarkets… During the early Middle Ages especially, wealth was rare. During this time holiness and wealth were often equated… It was clearly understood by everyone that helping the poor was a good Christian duty. There were however so many poor people that those with wealth essentially gave up. When most of the population was trying to scratch out a subsistence living, it was hard to know where to start.”

C. Dale Brittain, Life in the Middle Ages – 2016

The Truth About Capitalism

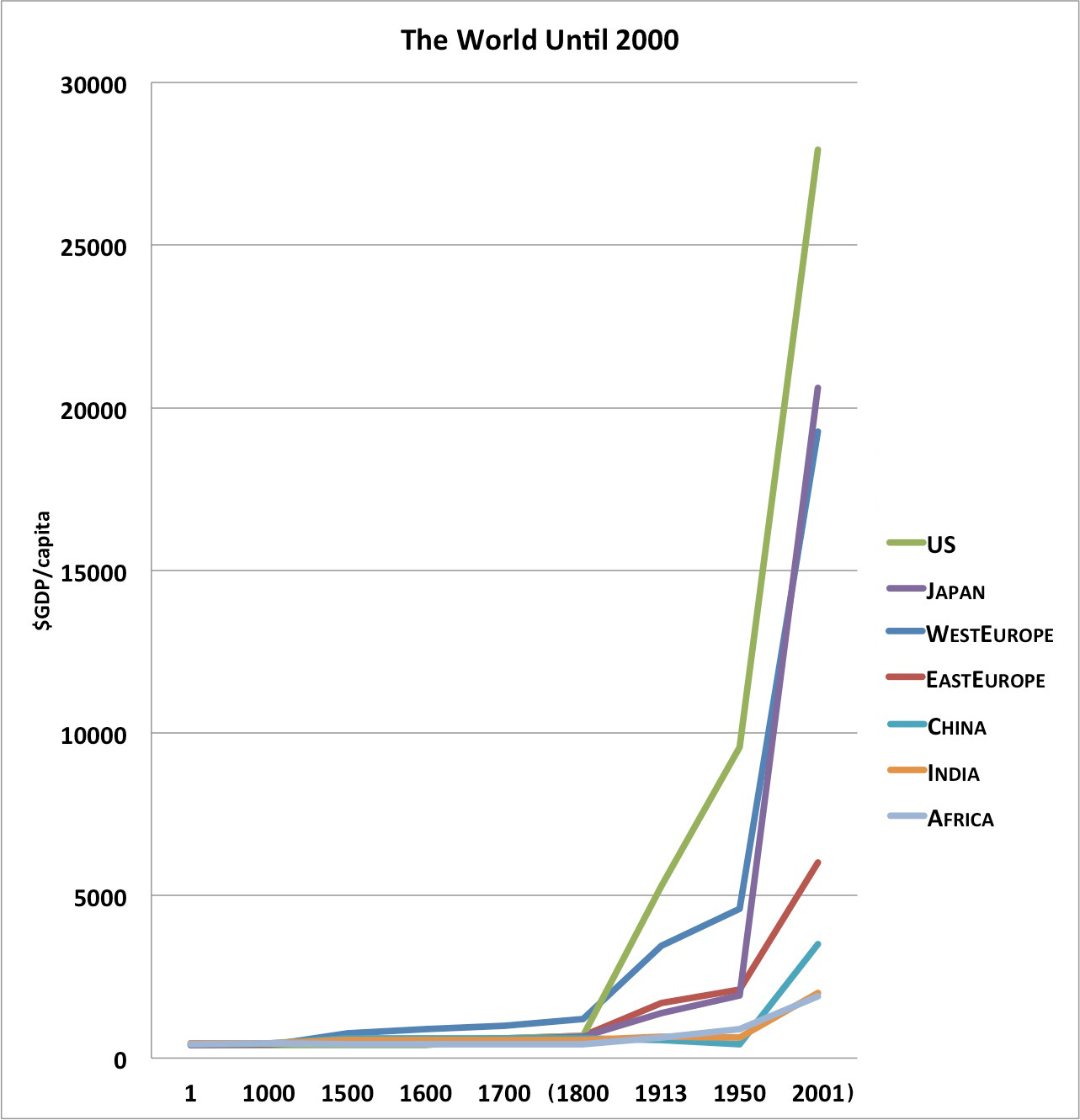

Capitalism has been greatly mischaracterized and maligned as a way of keeping poor people poor, which is historically and factually inaccurate. Although I purposefully do not use images or graphics in this book, I have made one exception, because this image is worth more than a thousand words. This graph represents the growth of wealth in individual countries in terms of Gross Domestic Product from year “0” until 2001. For all intents and purposes, wealth essentially did not grow in the world at all until the birth of Capitalism and the free market system in the early nineteenth century when wealth skyrocketed for the first time in history. This is because previously there was no system for creating and generating wealth.

Lae & Liberty, Capitalism’s Enigma and It’s Future

Until the advent of Capitalism there was no reason to even consider redistributing wealth, because previously in the world there was extremely limited wealth to distribute. This chart demonstrates that under capitalism, even though the majority of the newly generated wealth went to countries that embraced a capitalistic economy such as the United States, Japan, and Western Europe; even poorer countries without such systems, including India and Africa, gained more wealth than at any other time in their history, just as Adam Smith had predicted. China, since 2001, has embraced many more capitalistic principles and has also dramatically increased their economy, becoming a major economic power in the world today. Capitalism has had the single most positive effect and influence on wealth and overall economic growth in the world than any other factor in history. This holds true for nations, corporations, companies, and individuals.

Under Capitalism the great divide between the extremely rich, who were very few, and the extremely poor, who were very many, was filled by something not seen before: the middle class. This, in combination with freer more democratic forms of government, has led to the largest increase in national and individual wealth and technology than at any other time in recorded history; such that even an average ordinary person can afford to hold all the knowledge of the world in their hand, and has the power to communicate with anyone else in the world about virtually anything. If you use a “smart phone,” you can thank Capitalism.

“Free enterprise has produced in the United States an extraordinary lifestyle… we all enjoy privileges that weren’t available to the world’s wealthiest just a few decades ago. With access to something like the Internet, something that’s worth more than a dollar figure, we just might be richer than we realize.”

The Daily Signal, How Capitalism Makes Us Richer – July 13, 2001

Markets

Once a society, nation, or individual has produced a surplus, more than they actually need to survive, they have wealth. The most important factor in any economic plan is how that extra wealth is distributed. Unlike socialism, which distributes goods and services based on government mandate, Capitalism distributes goods and services through markets. Markets represent a system of free exchange with price as the self-regulating factor in the distribution of goods and services. Markets require no outside intervention to work; all decisions are made by the individuals involved in the transaction with the express purpose of reaching a mutually beneficial exchange in which all parties are happy and satisfied. This is why it is common for both seller and buyer to say “thank you” to each other at the end of a transaction. Under Capitalism all transactions are voluntary, for both the seller and the buyer.

“When you purchase something, you are telling the manufacturer of that product that the price is the right price.”

Most Americans don’t really understand that they set the price of goods and services, not the manufacturer. When you purchase something, you are telling the manufacturer of that product that the price is the right price. The proof of that is that you bought the product. If the price was too high, you would not have purchased the product; that would tell the manufacturer that the price was too high. At that point, the manufacturer can either lower the price, or go out of business. Many Americans don’t really believe that’s how it works, but it is. Consider the following real-life example regarding Apple Computer.

“While Jobs was a true genius in regard to the new technology that would transform the world, he was dead wrong in assuming that Apple would set the price for it.”

Today, the iPhone is ubiquitous throughout the world. However, when Apple first announced the release of its newest invention on June 29, 2007, Steve Jobs was hoping to gain only one percent of the lucrative cellphone market with his new smart phone. While Jobs was a true genius in regard to the new technology that would transform the world, he was dead wrong in assuming that Apple would set the price for it.

Steve Jobs appeared on a live webcast to announce, demonstrate, and most importantly sell the new all-in-one technology that would change the world and introduce the first smart phone. He held up three different devices available at the time: a cell phone, an iPod, and a very basic information management device commonly known as a personal digital assistant, or PDA. Each of these devices sold for about three-hundred dollars each at the time. Jobs holds up each device, explains its function, refers to each of the device’s retail price and askes, “Now, what if you could get all three of these devices for the same price as only…” I, and virtually everyone watching at the time, was anxiously waiting for that sentence to end with the word, “one.” But that wasn’t the word that came out of Steve Jobs’ mouth.

“I knew instantly that Apple was in trouble!”

Steve Jobs’ idea of what the new iPhone was worth was considerably higher than the expectation of those watching the broadcast. After setting the audience up to hear, “Now you can get all three devices for the price of only one!” he announced that you could “get all three devices for the price of only two!” Then held up the new iPhone and announced the price of $499 for the 4GB model and $599 for the 8GB model. I knew instantly that Apple was in trouble. The iPhone did not sell.

Consumers were anticipating getting three for the price of one, which made the value of the iPhone closer to $300, not $600. Barely three months later on September 5, 2007, Apple was forced to drop the price of the new iPhone from $599 to $399 and had to discontinue the 4GB model altogether. Once Apple dropped the price of the new device into the three-hundred-dollar range sales took off, and the rest is history. Steve Jobs and Apple did not set the price of the new iPhone; the market did. The market is you.

CONSIDERATION #25: Mutually Beneficial Exchange (Capitalism)

Adam Smith

“No society can surely be flourishing and happy, of which the far greater part of the members are poor and miserable.”

― Adam Smith, The Wealth of Nations

Adam Smith is considered the first modern economist. He implemented Kant’s call to actively question authority by attempting to scientifically investigate the standard accepted economic practices of his time. Using Enlightenment principles, Smith observed that human beings were natural “traders” who tended to act out of their own self-interest. If this were in fact true, then developing an economic system based on this truth made a lot of common sense.

"Man is an animal that makes bargains: no other animal does this - no dog exchanges bones with another."

– Adam Smith

At first it seems incredulous, because if everyone was running around doing whatever they wanted there would only be chaos. However, Adam Smith questioned this presumption, arguing that self-interest works out better when someone else also benefits. Thus, the birth of mutually beneficial exchange.

“If I want to sell a product, I must make a good product, otherwise no one will buy the product, which is not in my self-interest.”

Smith argued that there was, in fact, reason in a person’s self-interest and that it was completely rational. Smith concluded that in essence doing the “right” thing is in one’s own self-interest. If I want to sell a product, I must make a good product, otherwise no one will buy the product, which is not in my self-interest. According to Smith, “It is not from the benevolence of the butcher, the brewer, or the baker that we expect our dinner, but from their regard to their own interest.”

With this key precept in mind, Smith developed an economic system based completely on mutual benefit through individual self-interest called Capitalism. Because all exchanges are voluntary, there is no need for any kind of oversight or authority for individual transactions to occur. Smith called this self-generating mechanism of mutual self-interest the “invisible hand” that required no interference from power centers like government to function effectively and efficiently. In terms of Enlightenment thinking, it was pure economic freedom, or liberty.

“Business and wealth were no longer a zero-sum game in which there was a winner and a loser.”

In his book, The Wealth of Nations, Smith determined that as individual economic freedom increased, not only would individual wealth increase, but overall wealth in general. An atmosphere in which business and trade was allowed to grow freely could actually generate and increase new wealth indefinitely with no limit. Business and wealth were no longer a zero-sum game in which there was a winner and a loser. Given the freedom for everyone to pursue their own self-interest, everybody could win and prosper.

In terms of progress, Adam Smith’s economic ideas would transform the concept of wealth and who could, and should, possess it. For the first time in history, virtually anyone could gain wealth because it was no longer directly tied to the ownership of gold and silver. The establishment of the Gross Domestic Product (GDP) as a new determination of wealth brought a fundamentally new level of abundance to nations and individuals, as well as a level of science and technology that would completely alter our reality.

POSTSCRIPT

The essential argument made by Adam Smith in his theory of capitalism is that the most efficient means of distribution for goods, services, wealth, ideas, and choice is based on a universal trait of self-interest – an evolutionary force naturally motivating individuals and society toward a more positive direction and future. Our modern tendency is to treat this intention as quaint and simplistic, often connotating Smith’s concept of self-interest with greed. This is unfortunate in two ways: it limits the concept of self-interest to pure selfishness, and it camouflages the self-interest of those opposing capitalism.

“Consumers ultimately decide which products get made and which products die based on their choices…”

The way to truly exploit capitalism is to understand its greater potential and expand on its larger implication: Capitalism increases opportunity for each person to pursue and express their individual happiness through their individual choices. Some will choose to be entrepreneurs, while some will choose to be consumers, the definitive decision makers of capitalism. Consumers ultimately decide which products get made and which products die based on their choices, unless government subsidies are involved. Capitalism thrives on choice, individual choice. At times I think Americans forget how much they exercise that choice: what they wear, who they date, what they watch, where they work, what they do, Droid or iPhone, vegan or real meat? Americans make choices regarding everything they purchase. This is what a free-market economy looks like, and people love it.

People love their homes, their cars, their cellphones, their clothes, and a million other things. Why? Because those things are a direct reflection of them. What we own reflects who we are. And we are all different.

“Ownership helps give people a sense of control over their lives by giving them an opportunity to exercise their free will through free choice.”

The possibility of ownership represents the possibility of autonomy. When we own something, we can make it ours in many unique and expressive ways. The kind of house we own, the model of car we drive, the type of phone we use are all chosen to reflect our unique needs, identity and style. We love to personalize our belongings to match our own personality in terms of color, shapes, sizes, style and more. We customize things in multiple ways to make them even more “mine.” Ownership helps give people a sense of control over their lives by giving them an opportunity to exercise their free will through free choice. This is why one of America’s favorite pastimes is shopping. Americans love to shop, because it is a way of exercising their control, autonomy and individuality.

Americans are essentially free to choose how much they want to own and how much that is worth to them personally. Someone who wants a career leading to a penthouse in New York must certainly be prepared to put in more time, energy and work at their job than someone who longs for a small rural home to raise their family. Americans are free to possess as little as possible, or to essentially own as much as they want and are willing to work for; it is each individual’s choice.

“Liberty without choice is the ultimate irony.”

We have formulated our country and society based on our freedom to make decisions and choices that we feel will increase our happiness: our forefathers called this Liberty. That is why Liberty and Capitalism are natural companions: Liberty without choice is the ultimate irony. If we are unhappy with the condition of our present life or society, perhaps we should question our choices – not the freedom to make them

In America you can create a business and get rich or invest in a business and get rich. You can also lose your entire investment. However, it’s all voluntary. Sometimes you get Apple and sometimes you get Enron. But, over time you get more wealth, more choice, and more technology, as well as more opportunity for success and happiness. By embracing capitalism, America has generated a greater amount of wealth and opportunity than any other nation in any other time in history. For many people in the world, average Americans live like kings and queens. Capitalism represents the first effective form of economic liberty.

“Over the past two centuries, growth has increased living standards in the West unimaginably quickly. Many more babies survive to adulthood. Many more adults survive to old age. Many more people can be fed, clothed and housed. Much of the world enjoys significant quantities of leisure time. Much of the world can carve out decades of their lives for education, skill development and the moral formation and enlightenment that come with it. Growth has enabled this… Economic growth is the most effective tool for lifting people out of utter destitution in human history. This is true to this very day, and it is no small thing; it should not be treated and dismissed as a small thing…

‘It’ provides the money to make targeted spending programs possible. In a nation as rich as ours, no one should fall too far — no one should go hungry, everyone should have a baseline level of education, no one should be bankrupted by a catastrophic medical event. Slow growth impedes progress toward social goals that require targeted spending, both because of the political climate it fosters and because those goals, even only those that are advisable, are expensive.”

― Michael R. Strain, Why We Need Economic Growth... – October 21, 2015

Because many no longer understand the basic principles of capitalism, they often mistake non-capitalistic practices as being part of the capitalist process. For example, concepts and practices such as competition serve as critical factors in maintaining the free-market system. Therefore, mega-corporations wielding massive power because they have no competition would not reflect the idea of capitalism. Perhaps the only economic system more misunderstood than capitalism is Marxism. But that is for another time.

Next week Reason meets Revolution in the writings of Thomas Paine and the declaration of war by the American colonists against the greatest power of the time, Great Britain.

Learn More About the Idea of America: “Being American: A Primer for All Parties and Persuasions!” Available Exclusively from BooksNotOnAmazon.com

All Three “How Things Work” Books Including “Book-3 The Enigmatic Mystery” are Now Available in One Volume: “How Things Work – Volume I Science & Religion” for Only $9.95! Exclusively through BooksNotOnAmazon.com